Walmart Earnings: Strong Sales Growth, AI Push Amid Margin Headwinds

- Hardik Shah

- 3 days ago

- 3 min read

TLDR

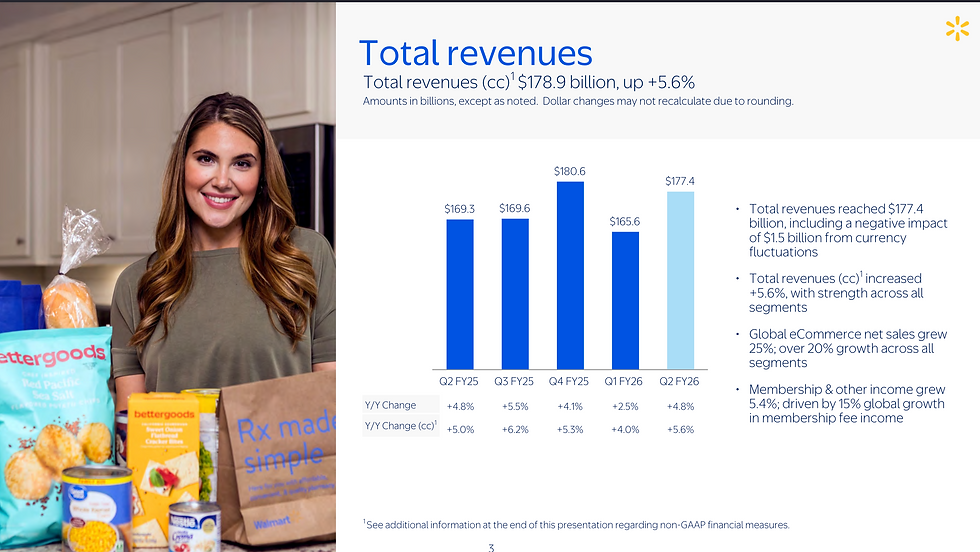

Revenue Strength: Q2 sales rose 5.6% in constant currency, with e-commerce up 25% globally.

Margin Trends: Operating income fell 8.2% (GAAP) but adjusted operating income rose slightly; claims expenses weighed heavily.

Forward Outlook: Management raised FY26 sales and EPS guidance, underscoring confidence despite tariffs and cost headwinds.

Business Overview

Walmart Inc. (NYSE: WMT) operates as the world’s largest omnichannel retailer with over 10,750 stores and a growing digital footprint across 19 countries. The company serves approximately 270 million customers weekly, spanning formats including Walmart U.S., Walmart International, and Sam’s Club. Core growth drivers include:

E-commerce & Marketplace: 25% global e-commerce growth, led by store-fulfilled pickup and delivery.

Advertising: Walmart Connect and VIZIO advertising delivered a combined 46% growth.

Membership: Strong renewal rates drove 15% global membership income growth.

Walmart Earnings Q2 FY26

Revenue: $177.4 billion, up 4.8% YoY (5.6% constant currency).

Segment Sales:

Walmart U.S.: $120.9 billion (+4.8%); comps up 4.6%.

Walmart International: $31.2 billion (+5.5%, +10.5% constant currency).

Sam’s Club: $23.6 billion (+3.4%, comps ex-fuel +5.9%).

Margins: Gross margin up 4 bps, with strength in Walmart U.S. offset by channel mix and strategic investments abroad.

Operating Income: $7.3 billion (-8.2% GAAP), impacted by ~$560M higher liability claims expense; adjusted operating income up 0.4% constant currency.

EPS: GAAP EPS $0.88 (+57% YoY) boosted by investment gains; Adjusted EPS $0.68.

Forward Guidance

Q3 FY26: Net sales growth +3.75% to +4.75%; operating income growth +3% to +6%; adjusted EPS $0.58–$0.60.

FY26 Outlook: Raised sales growth to +3.75% to +4.75% (from +3.0% to +4.0% prior); Adjusted EPS raised to $2.52–$2.62. Adjusted operating income guidance unchanged at +3.5% to +5.5%.

Risks & Opportunities: FX headwinds, tariff-related cost pressures, liability claim expenses, and consumer elasticity remain watchpoints. Opportunities include e-commerce scale, AI-driven efficiency, and advertising expansion.

Operational Performance

E-commerce: U.S. e-commerce sales surged +26%, with store-fulfilled delivery up nearly 50%; one-third of orders delivered in under three hours.

Advertising: Walmart Connect U.S. grew +31% (ex-VIZIO).

Membership: Sam’s Club membership income grew +7.6%; Walmart+ also posted double-digit gains.

Inventory: Up 2.2% in U.S. and 3.8% globally—healthy levels with strong back-to-school sell-through.

Market Insights

Competition: Management noted grocery delivery expansion from rivals but emphasized Walmart’s scale and convenience advantage.

Category Trends: General merchandise turned positive, led by apparel, media, gaming, and automotive. Grocery and health & wellness remain pillars of resilience.

Consumer Shifts: Rollbacks surged to 7,400 items, including a 30% increase in grocery, supporting price-sensitive shoppers amid tariffs.

Consumer Behavior & Sentiment

Middle- and lower-income households showed more adjustments, while higher-income cohorts contributed disproportionately to growth.

CEO Doug McMillon highlighted muted but noticeable trade-down behavior:

“In discretionary categories where item prices have gone up, we see a corresponding moderation in units as customers switch to other items or categories. As always, our customers are aware, smart, and value-conscious.”

Strategic Initiatives

Artificial Intelligence (AI): Walmart launched “super agents,” including Sparky, an AI-powered shopping assistant in its app. Other AI agents will streamline operations for associates, suppliers, and developers.

International Expansion: Strong growth in China (+30% sales), Walmex (+6%), and Flipkart; investments in QuickCommerce in India and platform integration in Mexico/Canada.

Financial Products: Walmart to launch a OnePay cash rewards credit card, offering up to 5% cashback for Walmart+ members.

“We’re seizing the moment with AI… Sparky will become an indispensable part of how people shop with us.” – Doug McMillon, CEO

Capital Allocation

Buybacks: Repurchased 67.4M shares YTD ($6.2B).

Dividends: $0.94/share paid in H1, up from $0.83 last year.

Debt & Liquidity: $9.4B cash on hand; total debt $50.3B.

Capex: ~3–3.5% of net sales, focused on automation and tech.

The Bottom Line

Walmart delivered another quarter of resilient sales growth and raised FY26 outlook, powered by e-commerce, advertising, and membership gains. Margin pressure from liability claims and tariffs remains a challenge, but leadership reiterated confidence in the long-term model.

For investors, three takeaways:

Structural growth drivers (e-commerce, advertising, membership) are reshaping profitability.

AI initiatives mark a new phase of digital transformation with customer-facing and operational applications.

Tariffs and claims costs are near-term headwinds, but Walmart’s scale and flexibility position it to sustain share gains.

--

Stay informed. We break down earnings, trends, and policy shifts shaping consumer staples and adjacent industries — no paywalls, no newsletters, just actionable insights wherever you scroll. Follow more earnings insights on LinkedIn and X.

Comentarios