First Watch Earnings: Traffic Rebounds, EBITDA Outlook Raised on Commodity Relief

- Hardik Shah

- Aug 5, 2025

- 3 min read

TLDR

📈 Revenue Strength:Revenue rose 19.1% YoY to $307.9M, driven by new unit openings and improved same-store sales.

💰 Margin Trends:Margins compressed due to commodity inflation and higher labor costs; Adjusted EBITDA margin fell to 9.9%.

🔮 Forward Outlook:Guidance raised for FY25 Adjusted EBITDA ($119M–$123M); traffic momentum and lower egg costs support margin recovery.

Business Overview

First Watch Restaurant Group, Inc. (NASDAQ: FWRG) is a leading Daytime Dining concept operating over 600 restaurants across 31 U.S. states. The brand serves breakfast, brunch, and lunch during a single 7.5-hour shift (7 a.m.–2:30 p.m.), appealing to a wide demographic—from Gen Z to Boomers—via a fresh, chef-driven menu that rotates seasonally.

Their business is anchored in:

Made-to-order meals

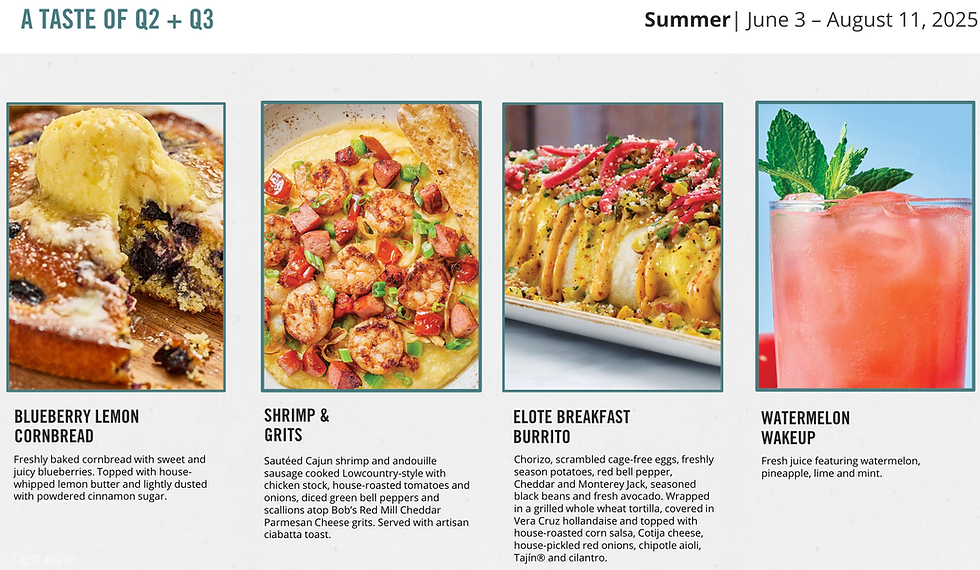

Seasonal innovation (menus change every 10 weeks)

Flexible formats (freestanding and second-generation locations)

Customer-first digital enhancements (automated waitlist, nutrition filters)

First Watch Earnings Q2'25

Revenue: $307.9M, up 19.1% YoY

System-wide Sales: $346.2M, up 15.8% YoY

Same-restaurant Sales: +3.5%

Same-restaurant Traffic: +2.0%

Net Income: $2.1M vs. $8.9M YoY

Adjusted EBITDA: $30.4M vs. $35.3M YoY

Adjusted EBITDA Margin: 9.9%, down from 13.7%

Restaurant Operating Profit Margin: 18.6%, down from 21.9%

Operating Income Margin: 2.4%, down from 6.4%

Openings: 17 new restaurants (15 company-owned, 2 franchise-owned)

📉 Margin compression was driven by:

Commodity inflation (+8.1%), particularly on eggs, bacon, coffee, and avocados

Labor inflation (+3.9%) and rising health benefit costs

Marketing and headcount investments

Forward Guidance

📊 Management Outlook

Adjusted EBITDA: $119M–$123M (raised from $114M–$119M)

Total Revenue Growth: ~20%

Same-restaurant Sales Growth: Low-single digits

Capital Expenditures: $148M–$152M

Net New Openings: 59–64 system-wide units (mostly company-owned)

“Looking ahead, we anticipate stronger profitability in the second half of the year... we remain confident in our momentum through the balance of 2025 and beyond.” — Chris Tomasso, CEO

⚠️ Risks & Opportunities

Tailwinds:

Lower egg prices (commodity cost guidance reduced to 5–7%)

Continued traffic growth in both dine-in and third-party delivery

Watchouts:

High food input inflation

Seasonal Q3 demand softness

Lapping strong 2024 promotional comps in Q3

Operational Performance

Unit Growth: Company on track for 62–67 new openings in 2025; more than 130 sites in development

Real Estate Strategy: ~40% of recent openings are second-gen conversions, offering cost and speed advantages

Digital Upgrades: Relaunching customer-facing platforms including a geolocation-enabled waitlist and streamlined online ordering

Labor: Turnover below industry averages; expanding management pipeline via Certified General Manager and FARM programs

Market Insights

Daypart Strength: Traffic growth consistent across all dayparts, including record-setting holidays like Mother’s Day and Father’s Day

Third-Party Delivery: Traffic rebounding due to strategic tweaks; incremental rather than cannibalizing dine-in

Pricing Strategy: 2.8% price action in July; long-term pricing philosophy targets ~3–3.5% annually

Consumer Behavior & Sentiment

Demographic Shift: Younger generations now make up the majority of customers, thanks to social media engagement, menu evolution, and digital UX

Loyalty & Frequency: Marketing efforts driving frequency among core customers and attracting new ones in growth markets

Menu Appeal: Seasonal dishes like Shrimp & Grits, Elote Breakfast Burrito, and Wild Berry French Toast continue to resonate with evolving tastes

“Our customers are skewing more towards the Gen Z and millennial generations... a direct result of our marketing, culinary and operational efforts.” — Chris Tomasso, CEO

Strategic Initiatives

Brand Refresh: Digital interface upgrades and waitlist automation enhance convenience

Menu Innovation: Continuous R&D with new seasonal rotations and platform experimentation

Real Estate: Focus on highly visible A+ locations with customizable layouts, including second-gen sites

People Development: FARM program expands leadership bench strength, aiding scale

“Each year, we are opening the equivalent of an entire regional chain... doing it with a well-formed playbook.” — Chris Tomasso, CEO

Capital Allocation

CapEx: Targeting $148M–$152M, mostly for new builds and remodels (excluding franchise buyouts)

Buybacks & Dividends: Not emphasized in this quarter’s update

Franchise Acquisitions: Added 19 units in NC, SC, and MO; contributing ~$7M in revenue and $1M in EBITDA in Q2

The Bottom Line

First Watch continues to distinguish itself in the full-service dining space with:

Sustained traffic momentum and a strong development pipeline

Broadening consumer appeal and efficient site conversion model

Raised profit outlook despite short-term margin pressures

Investor Watchpoints:

Will Q3 consumer softness and lapping challenges slow momentum?

Can easing commodity inflation fully offset labor and marketing investments?

Will digital upgrades drive material improvements in throughput or loyalty?

--

Comments