Kroger’s Q4 Earnings Beat Expectations Amid Strong Digital Growth

- Hardik Shah

- Mar 6, 2025

- 3 min read

TL;DR

Solid Financial Performance: Q4 2024 identical sales without fuel rose 2.4%, while adjusted FIFO operating profit reached $1.17 billion.

Digital Momentum: Digital sales grew 11%, driven by expanded fulfillment and alternative profit businesses.

Strategic Capital Allocation: $5 billion accelerated share repurchase program underway, with continued investment in store expansions.

Financial Results

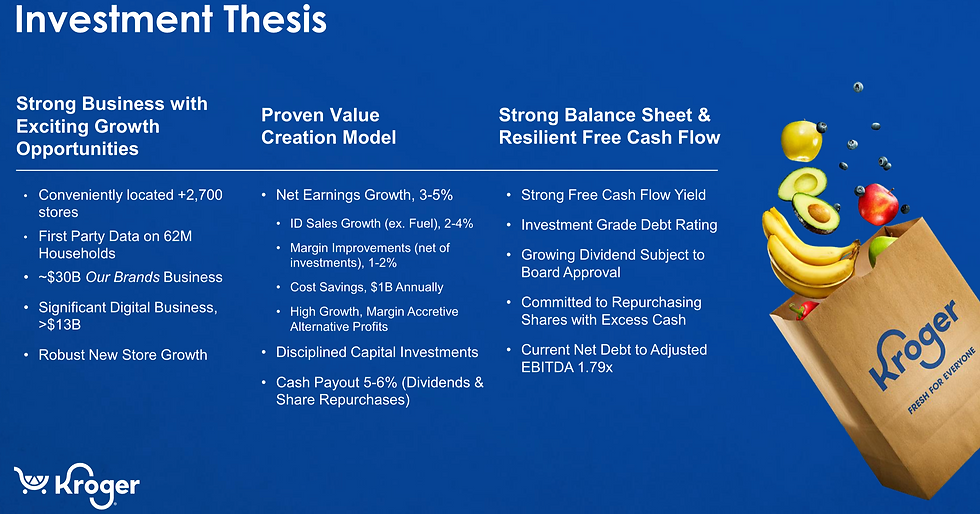

Kroger operates as one of the largest grocery retailers in the U.S., leveraging a mix of in-store, digital, and private-label brand strategies. The company serves millions of customers daily through traditional supermarkets, digital delivery services, and alternative profit channels.

Kroger Q4'24 Earnings

Revenue: Q4 sales reached $34.3 billion (excluding fuel and the 53rd week, up 2.6% YoY).

Operating Profit: Reported $912 million for Q4, compared to $1.19 billion in Q4 2023.

EPS: Adjusted EPS for Q4 stood at $1.14, flat YoY when excluding the extra week in 2023.

Margins: FIFO gross margin improved 54 basis points, driven by the sale of Kroger Specialty Pharmacy and lower shrink.

Digital Sales: $13 billion in FY 2024 digital sales, an 11% YoY increase.

Management Guidance for 2025

Sales Growth: Identical sales without fuel expected to grow 2.0% to 3.0%.

Profitability: Adjusted FIFO operating profit guidance of $4.7 - $4.9 billion.

EPS Projection: Expected $4.60 - $4.80 per diluted share.

Capital Investments: $3.6 - $3.8 billion, including store expansions.

"We enter 2025 with positive momentum, focused on delivering an incredible customer experience through great quality at low prices." – Ron Sargent, Interim CEO

Operational Performance

Industry & Market Trends

Inflationary pressures are stabilizing, with Kroger projecting 1.5% to 2.5% inflation in 2025.

Egg prices surged 70% due to the avian flu outbreak, but other grocery prices remained steady.

The alternative profit business (including media and health) contributed $1.35 billion in operating profit.

Key Business Milestones

Expanded Private Label Offerings: Over 900 new Our Brands products introduced in 2024.

Digital Growth: 18% increase in delivery sales, fueled by Kroger’s Ocado fulfillment network.

Customer Engagement: Increased retention and loyalty among digital-first shoppers, who spend nearly 3x more than non-digital shoppers.

Challenges & Risks

Macroeconomic Headwinds: Higher interest rates are pressuring budget-conscious consumers.

Tariff Exposure: Minimal impact from China tariffs, though some produce imports from Mexico may see mid-single-digit effects.

Pharmacy Margin Pressures: Higher GLP-1 drug sales (for weight loss and diabetes) weighed on pharmacy profitability.

"We continue to optimize digital profitability through automation, technology, and increased order density." – Todd Foley, Interim CFO

Strategic Initiatives

Investments & Growth Areas

Technology & AI: Expanded AI-powered assistant for 70,000 employees to improve labor efficiency.

Store Expansion: 30 major store remodels planned for 2025, with more new openings expected beyond 2025.

Healthcare Partnerships: Renewed Express Scripts agreement to drive pharmacy growth.

Capital Allocation Strategy

Share Buybacks: $5 billion accelerated repurchase program in progress, part of a $7.5 billion authorization.

Debt & Liquidity: Increased debt to fund buybacks, with interest expense expected at $650 - $675 million in 2025.

Dividend Growth: Continued commitment to increasing quarterly dividends, subject to board approval.

"Our balance sheet strength allows us to invest for growth while returning capital to shareholders." – Todd Foley, Interim CFO

The Bottom Line

Kroger delivered solid Q4 and full-year results, highlighting strong digital momentum, strategic cost efficiencies, and robust capital allocation. As the company navigates macroeconomic challenges, its focus on private-label expansion, digital transformation, and alternative profit streams positions it well for long-term sustainable growth in 2025 and beyond.

--

Comments