Primo Brands Q2 2025 Earnings: Premium Water Shines Despite Integration Disruptions

- Hardik Shah

- Aug 7, 2025

- 3 min read

TLDR

📈 Revenue Strength:Comparable net sales fell 2.5% YoY due to a tornado impact and integration disruptions, but premium water grew 44.2%.

📉 Margin Trends:Adjusted EBITDA margin expanded 80 basis points to 21.2%, driven by synergy capture and premium mix.

🔮 Forward Outlook:Guidance lowered; net sales growth now expected at 0–1% with $1.5B in adjusted EBITDA and $740–760M in free cash flow.

Business Overview

Primo Brands Corporation (NYSE: PRMB) is a leading North American branded beverage company focused on healthy hydration. Its portfolio includes premium and regional bottled water brands (e.g., Poland Spring®, Mountain Valley®, Pure Life®), enhanced water (Splash Refresher™, AC+ION®), and water dispensers. Distribution spans grocery, mass, and direct-to-consumer channels, reaching over 200,000 retail outlets and 3M+ delivery customers.

Formed by the late-2024 merger of Primo Water and BlueTriton, the company operates dual headquarters in Stamford, CT, and Tampa, FL.

Primo Brands Earnings Q2'25

Revenue

Reported Net Sales: $1.73B (+31.6% YoY) due to merger accounting.

Comparable Net Sales: $1.73B (-2.5% YoY) driven by:

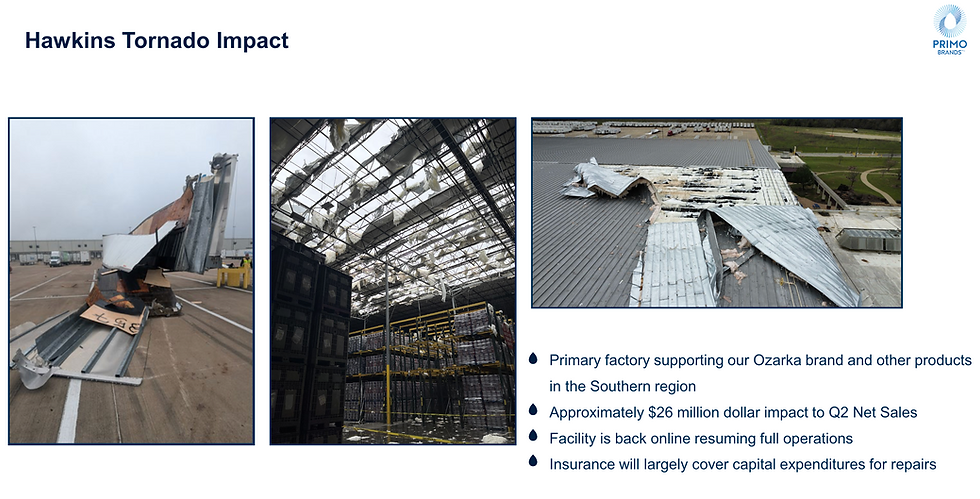

📉 Hawkins, TX tornado: -$26M

📉 Tariff-related dispenser softness: -$10M

📉 Coffee service wind-down: -$6M

Margins and Profitability

Adjusted EBITDA: $366.7M (+1.3% YoY comparable, +42.1% reported)

Adjusted EBITDA Margin: 21.2% (+80 bps YoY)

Gross Margin: 31.3% (-140 bps YoY) due to integration mix

Other Metrics

Adjusted Net Income: $137.1M (+$60.4M YoY)

Adjusted EPS: $0.36 (flat YoY)

Adjusted Free Cash Flow: $169.7M (+$96.5M YoY)

Dividend: $0.10/share (payable Sept 4)

Buyback Authorization: $250M

Forward Guidance

Net Sales Growth: Now 0–1% (vs. prior 3.5–4%)

Adjusted EBITDA: $1.485B–$1.515B (was $1.56B midpoint)

Free Cash Flow: $740M–$760M

Base CapEx: ~4% of net sales

“We believe we are taking the right steps to resolve the service issues... our business model is resilient and is well positioned to deliver growth, improve margins, and generate strong cash flow going forward.” – Robbert Rietbroek, CEO

Risks & Opportunities

Opportunities: Premium water strength (+44.2%), expanded distribution, integration synergies

Risks: Integration friction, service recovery, weather-driven retail softness, tariff impacts on dispensers

Operational Performance

Integration Update:

Closed 40+ facilities in Q2

Headcount cut by 1,100 in Q2 (1,600 YTD)

SAP rollout and new handheld devices strained service

Hawkins Tornado:

Facility back online

Insurance to cover most repair capex and business interruption

Premium Channel Highlights:

Mountain Valley & Saratoga: 44.2% YoY sales growth

Expanded shelf space at Walmart, influencer/award show campaigns

Broke ground on a new production facility in Arkansas (completion: 1H 2026)

“Our premium water performance continues to shine... We’re addressing elevated demand with additional capacity to ensure availability.” – Robbert Rietbroek, CEO

Market Insights

Retail Trends:

Retail dollar share up 17 bps YTD, with 5 weeks of consecutive gains in July

Weather disruptions (wet May/June) hurt Q2 volume, especially in Northeast (Poland Spring territory)

Direct Delivery:

Disruptions caused delivery failures, canceled orders

Recovery actions underway; full normalization expected by September

“We believe we will exit Q4 resuming growth… customer demand remains strong as we stabilize supply and improve service.” – David Hass, CFO

Consumer Behavior & Sentiment

Consumers continue to prioritize quality hydration amid infrastructure and environmental concerns

Premium offerings gaining traction as affordable luxury

Tariff-related uncertainty impacted dispenser sales, but these account for just ~1% of revenue

Strategic Initiatives

Synergy Capture: $200M targeted in 2025; $300M by 2026

Cross-Selling: Expanded in direct delivery (e.g., offering premium spring water upgrades)

Channel Growth: 10% increase in total retail points of distribution

Brand Partnerships: MLB, Academy of Country Music Awards visibility boosts

Capital Allocation

Dividends: Quarterly payout of $0.10/share; +11% YoY

Buybacks: New $250M authorization

Leverage: Net leverage at 3.44x; targeting deleveraging

Liquidity: $1.02B (cash + revolver availability)

The Bottom Line

Primo Brands is navigating a transformational year marked by the complexities of integration. While service disruptions and tornado impacts dampened Q2 performance, strong premium brand momentum, disciplined synergy execution, and resilient demand underpin the company's long-term outlook.

Investors should watch for:

Stabilization of direct delivery service in Q3.

Continued momentum in premium and retail sales.

Margin improvement as synergies scale and disruptions ease.

Despite lowered guidance, Primo's positioning in healthy hydration, strong cash flow profile, and balanced capital returns strategy offer long-term upside.

--

Comments