SunOpta Earnings: 17% Volume Surge Stresses Supply Chain but Fuels Growth

- Nov 5, 2025

- 4 min read

TLDR

• Revenue Strength: Sales jumped 17% to $205.4M, led by strong beverage, broth, and fruit snack demand.

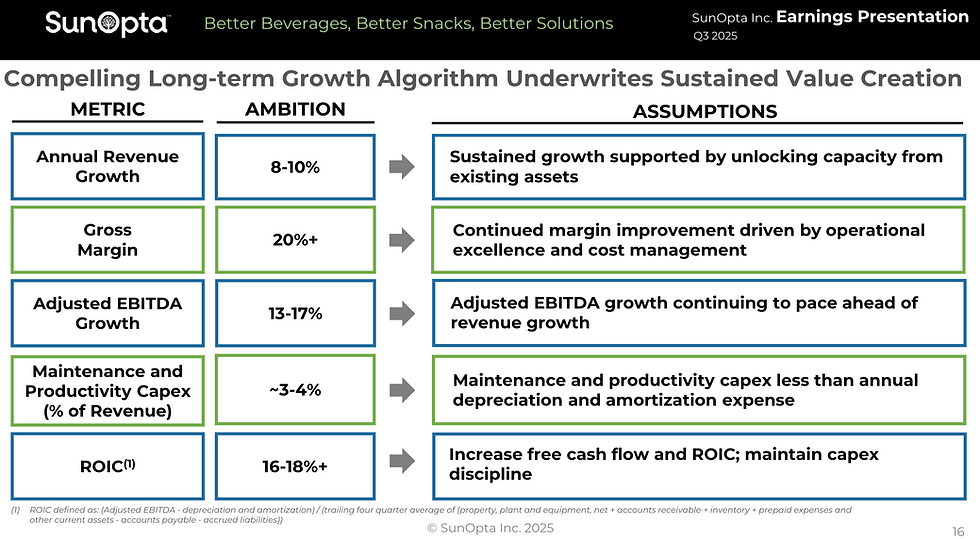

• Margin Trends: Adjusted EBITDA rose 13%, though margins dipped as rapid growth strained operations.

• Forward Outlook: SunOpta expects $812–816M FY25 revenue and $865–880M FY26, with margins recovering by mid-2026.

Business Overview

SunOpta Inc. (NASDAQ: STKL; TSX: SOY) is a North American food and beverage manufacturer specializing in plant-based beverages, broths, and better-for-you fruit snacks. The company provides customized supply chain and co-manufacturing solutions for major retailers, foodservice operators, and consumer brands. With over 50 years of expertise, SunOpta’s operations span the U.S. and Canada, including key facilities in Midlothian, Texas, and Omak, Washington. It services retail, club, and foodservice channels with a focus on sustainability-forward offerings.

SunOpta Earnings

Revenue: Up 16.8% year-over-year to $205.4M, driven entirely by volume growth across beverages, broths, and fruit snacks.

Gross Profit: Increased 11% to $25.5M, while gross margin fell 60 bps to 12.4% due to higher maintenance, labor, and waste costs amid rapid scale-up.

Operating Income: Rose sharply to $6.9M from $0.8M last year, reflecting higher gross profit and lower SG&A expenses.

Net Income: Turned positive at $0.8M, compared to a $6.2M loss in the prior year.

Adjusted EBITDA: Grew 13% to $23.6M, supported by operational leverage from volume growth.

Cash Flow: Operating cash flow reached $34.1M, nearly doubling from the prior year, enabling leverage reduction to 2.8x.

Balance Sheet: Debt remained stable at $265.8M, while total assets reached $694M.

Forward Guidance

FY25 Outlook: Revenue of $812–816M and Adjusted EBITDA of $90–92M (down from prior $99–103M guidance) as short-term costs weigh on margins.

FY26 Outlook: Revenue expected at $865–880M with Adjusted EBITDA of $102–108M, signaling a return to double-digit EBITDA growth.

Free Cash Flow: Projected at $20–22M, with priority given to debt repayment.

Leverage: Expected to hold steady around 2.8x through 2026 despite capacity investments.

Operational Performance

CEO Brian Kocher credited the team for “exceeding production targets despite short-term stress on our supply chain,” adding that rapid 17% volume growth accelerated demand originally forecast for 2026.

Key takeaways:

Supply Chain Pressure: Volume surge led to higher overtime, maintenance, and compliance costs, particularly at the Midlothian, TX plant, which faced wastewater capacity limits.

Investment Response: A new aseptic line in Midlothian (already 50% subscribed) and a fruit snack line in Omak, WA are being added to meet customer demand through 2028.

Margin Recovery: Management expects margin expansion initiatives to resume by mid-2026, once infrastructure upgrades are complete.

CFO Greg Gaba emphasized transparency: “We know the root causes of the short-term cost increase and have corrective action plans underway to return to our margin trajectory by mid-2026.”

Market Insights

SunOpta’s growth outpaces the broader food and beverage market as it benefits from category tailwinds in plant-based and functional beverages.

Plant-Based Beverages: Up high teens; demand fueled by coffee shop expansion—SunOpta supplies 8 of the top 10 U.S. chains.

Broth: Up high single digits, supported by club and co-manufacturing wins.

Fruit Snacks: Marked 21 consecutive quarters of double-digit growth, underscoring consumer preference for better-for-you snacking.

Kocher noted, “Our categories are roaring—customers are voting with their business, and they’re voting for us.”

Consumer Behavior & Sentiment

Despite broader consumer spending caution, SunOpta’s portfolio skews toward non-luxury, affordable staples like coffee add-ins and snacks priced under $0.50 each. The company’s exposure to value and private-label channels cushions it from macro headwinds. Kocher observed that “consumers may trade down from brands, but we’re represented across every channel—from club to foodservice to retail—so we capture that shift.”

Strategic Initiatives

Capacity Expansion: $35M investment in new aseptic line to expand beverage/broth production by 10% by late 2026.

Operational Resilience: Wastewater treatment upgrades in Midlothian to unlock full plant efficiency.

Portfolio Optimization: Exiting low-margin aseptic tote filling to prioritize high-value products and long-term customer relationships.

Sustainability: Continuing to source and package globally while mitigating tariff exposure through alternative sourcing.

Capital Allocation

Deleveraging Focus: Maintaining leverage below 3x.

Growth CapEx: ~$30–35M annually for plant expansions and automation.

Shareholder Returns: No dividend declared; future cash prioritizes debt reduction and reinvestment in high-return projects.

The Bottom Line

SunOpta’s Q3 showcased explosive demand-led growth, but at a temporary cost to margins. With corrective actions underway and new capacity slated for 2026, the company is well-positioned for sustained revenue momentum and margin recovery.

Investors should watch for:

Timely completion of Midlothian wastewater and capacity projects.

Execution of cost recovery and efficiency plans.

Continued strength in plant-based and fruit snack categories as demand remains above capacity.

SunOpta’s disciplined growth playbook suggests near-term noise but long-term structural upside as it solidifies its role as a critical partner in the plant-based and wellness supply chain.

--

Comments