Sweetgreen Earnings: Q2 Miss Amid Headwinds, Strategic Shifts Underway

- Hardik Shah

- Aug 7, 2025

- 3 min read

TLDR

• Revenue Strength: Revenue rose 0.5% YoY to $185.6M, driven by new units but offset by comp sales decline.

• Margin Trends: Restaurant-level margin dropped 360bps to 18.9%, pressured by sales deleverage, tariffs, and loyalty transition.

• Forward Outlook: FY25 guidance reaffirmed; momentum expected from seasonal menus, loyalty re-engagement, and operational resets.

Business Overview

Sweetgreen, Inc. (NYSE: SG) is a fast-casual restaurant and lifestyle brand serving healthy, made-from-scratch meals with a digital-first approach. With over 260 locations across the U.S., Sweetgreen emphasizes sustainability, local sourcing, and culinary innovation. Digital channels account for 60.8% of revenue, with 33.4% from owned digital platforms. Key urban markets include New York, Los Angeles, and Washington, D.C.

Sweetgreen Earnings Q2'25

Revenue:

Total revenue rose slightly to $185.6M, up 0.5% YoY.

Growth was driven by 33 net new restaurant openings, offset by a (7.6%) same-store sales decline, reflecting:

(10.1%) drop in traffic and mix

+2.5% menu price increases

Margins & Profitability:

Restaurant-Level Profit: $35.1M (18.9% margin), down from 22.5% in Q2'24.

Adjusted EBITDA: $6.4M (3.5% margin), down from $12.4M YoY.

Net Loss: $(23.2)M vs. $(14.5)M YoY

Loss from Operations Margin: (14.2%), vs. (8.8)% prior year

Margin compression attributed to:

Sales deleverage

Increased protein portions

Loyalty program transition

Packaging tariffs (+40bps)

Forward Guidance

Management Outlook:For full-year 2025, Sweetgreen expects:

Revenue: $700M–$715M

Same-Store Sales: (6%) to (4%)

Restaurant-Level Margin: ~17.5%

Adjusted EBITDA: $10M–$15M

Net New Restaurants: ≥40 (20 featuring Infinite Kitchen automation)

Risks & Opportunities:

Macroeconomic pressures and urban softness remain headwinds

Infinite Kitchen automation and menu innovation offer long-term margin expansion potential

Loyalty transition drag expected to reverse into a tailwind by Q4

Operational Performance

New Units: 9 new restaurants opened in Q2; Forest Hills, NY cited as one of strongest openings ever

Real Estate Optimization: Older, underperforming units in NYC closed; volumes successfully transferred to newer locations

Labor Optimization: Despite deleverage, labor cost per store improved YoY

Restructuring: 10% reduction in open and existing roles; G&A now 18.6% of revenue, down from 21.2%

Market Insights

Urban markets, especially in the Northeast, remain pressured

Higher consumer scrutiny on value, with demand more muted post-pandemic

Competitor activity and broader QSR inflation trends influencing price perception

Consumer Behavior & Sentiment

Loyalty Program Transition:

SG Rewards rollout led to a 250bps drag on Q2 comps

Temporary impact due to deferred revenue recognition and churn from SweetPass Plus cohort

Active membership growing; CRM offers driving frequency recovery

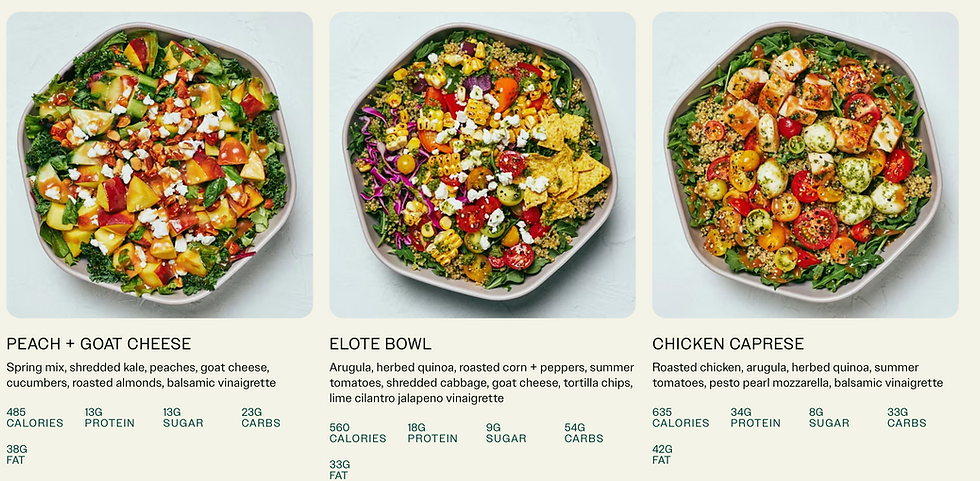

Menu Innovation:

Summer menu launched July 7; 15% of all entrees mix

1-in-3 customers who tried seasonal items returned within 2 weeks

30% increase in satisfaction related to larger protein portions

Dining Channel: Dine-in remains a strategic focus for higher quality experiences and trial conversion

Strategic Initiatives

Project One Best Way: New COO Jason Cochran leading system-wide effort focused on throughput, consistency, and food standards

Menu Strategy: At least 2 seasonal menus in 2H 2025; 8 planned for 2026

Operational Excellence: Targeting consistency across fleet with objective P&L and throughput metrics

Tech & Automation: Infinite Kitchen locations outperforming peers in labor efficiency, throughput, and digital mix

“We’re focused on reinvesting efficiencies into protein portions, loyalty value, and team training to build a flywheel of increased traffic and guest satisfaction.” — CEO Jonathan Neman

Capital Allocation

Cash Position: $168M in cash and equivalents

CapEx: $40.3M YTD, mainly for new restaurant openings and tech upgrades

No share repurchases or dividends declared

Leverage: No material long-term debt; future investments in Infinite Kitchen and real estate repositioning prioritized

The Bottom Line

Sweetgreen’s Q2 2025 results reflect a transitional phase marked by macro softness, loyalty reset challenges, and intentional reinvestments in product and people. While comps and margins declined, management's conviction in its operational roadmap, menu innovation, and Infinite Kitchen automation offers a clear path to long-term scale and profitability. Key to watch: sequential comp recovery in Q3, loyalty momentum, and execution on operational upgrades.

—

Comments