Sysco Earnings: Q4 Beat Fueled by Sourcing Gains and Strong International Growth

- Hardik Shah

- Jul 29, 2025

- 3 min read

TLDR

• Revenue Strength:Sales rose 2.8% in Q4 and 3.2% for FY25, driven by strength in international markets and national account growth.

• Margin Trends:Gross profit grew 3.9% with 19 basis points of margin expansion; adjusted EPS climbed 6.5%, aided by sourcing initiatives.

• Forward Outlook:FY26 guidance includes 3–5% sales growth and adjusted EPS of $4.50–$4.60, despite a $100M comp headwind.

Business Overview

Sysco Corporation (NYSE: SYY) is the world’s largest food-away-from-home distributor, serving approximately 730,000 customer locations across restaurants, healthcare, education, lodging, and entertainment. The company operates 337 distribution centers in 10 countries, with a portfolio spanning fresh produce, premium proteins, specialty products, and culinary solutions. In FY25, Sysco reported $81.4 billion in revenue.

Sysco Earnings

Q4 FY25 Highlights (YoY)

Sales: $21.1B, up 2.8% (up 3.7% ex-Mexico divestiture)

Gross Profit: $4.0B, up 3.9%; gross margin expanded 19 bps to 18.9%

Operating Income: $889M, down 9.0%; adjusted OI rose 1.1% to $1.1B

Net Income: $531M, down 13.2%; adjusted NI up 3.3% to $716M

EPS: $1.10, down 10.6%; adjusted EPS rose 6.5% to $1.48

EBITDA: $1.1B, down 6.5%; adjusted EBITDA up 1.8%

FY25 Full-Year Results

Sales: $81.4B, up 3.2%

Gross Profit: $15.0B, up 2.5%

Operating Income: $3.1B, down 3.6%; adjusted OI up 1.2%

Net Income: $1.8B, down 6.5%; adjusted NI up 0.8%

EPS: $3.73, down 4.1%; adjusted EPS $4.46, up 3.5%

Free Cash Flow: $1.8B, down 18.7%

Shareholder Returns: $2.3B via $1.3B in buybacks and $1B in dividends

“We are pleased with our strong Q4 performance and more importantly, the strong exit velocity... The momentum has carried into July,” said CEO Kevin Hourican.

Forward Guidance

Management Outlook (FY26)

Sales: $84B–$85B (+3–5%)

Adjusted EPS: $4.50–$4.60 (+1–3%), excluding a $0.16/share incentive comp headwind, normalized growth would be 5–7%

CapEx: ~$700M

Shareholder Returns: $1B in buybacks, $1B in dividends (6% YoY dividend increase)

Risks & Opportunities

Potential headwinds from FX, macro uncertainty, and inflation

Growth tailwinds from improved retention, AI-powered CRM, and revamped loyalty program ("Perks 2.0")

Operational Performance

U.S. Foodservice (USFS): Sales up 2.4%, volume down 0.3%; local case volume down 1.5%, but improved 200 bps sequentially

International Segment: Sales up 3.6% (8.3% ex-Mexico JV); operating income up 26.1% (20.1% adjusted)

Sigma Segment: Q4 sales up 5.9%, full-year sales up 8.3%; operating income up 12.5% YoY

“Our international segment posted its seventh consecutive quarter of double-digit profit growth... with strong contributions from Canada, Great Britain, Ireland and Latin America” — Kevin Hourican.

Market Insights

While overall restaurant traffic declined 1.1% in Q4, Sysco outperformed through strategic sourcing, customer optimization, and contract enhancements. National account volume rose 1.3%, especially in non-commercial categories like education and healthcare. Local business improved despite FreshPoint exit drag.

“Gross profit within national sales grew almost three times faster than volume due to excellent efforts to improve profitability…” — Hourican.

Consumer Behavior & Sentiment

Continued trade-down pressures persisted across restaurants, but Sysco retained strength among high-frequency, high-volume customers.

New customer wins outpaced losses significantly in Q4—gap doubled vs. Q1–Q3.

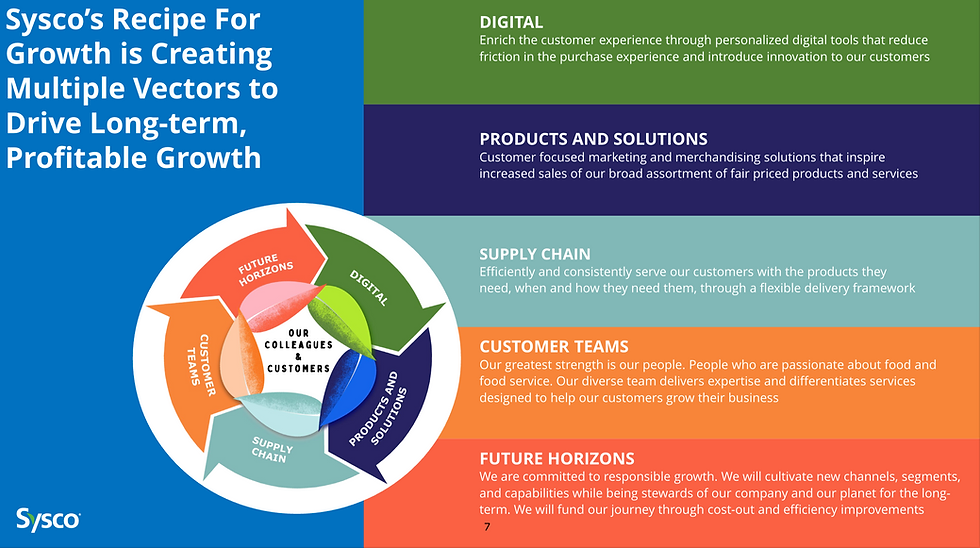

Strategic Initiatives

Sales Force Transformation: Stabilized turnover; improving productivity via training and tenure growth

AI-Driven CRM ("AI 360"): Improving close rates and sales rep effectiveness

Loyalty Program Revamp ("Perks 2.0"): Repositioned as a high-impact retention and service tool for top-tier customers

Pricing Agility: Sales reps enabled to dynamically respond to pricing with AI tools

Capital Allocation

Buybacks: $1.3B repurchased in FY25, $1B planned for FY26

Dividends: $1B paid in FY25, 6% increase planned

Debt Position: Net debt/adj. EBITDA at 2.9x (targeting 2.5–2.75x); liquidity of $3.8B

CapEx: $692M in FY25; includes expansion projects like new UK facility

The Bottom Line

Sysco exited FY25 with strong operational momentum, driven by strategic sourcing, improved salesforce productivity, and international strength. FY26 is poised to build on this trajectory with modest sales growth, profitability expansion, and capital returns—even amid macro uncertainty.

Watch for:

Positive inflection in U.S. local case volumes

Continued international outperformance

Measurable benefits from AI-driven sales and loyalty tools

“The pie is getting bigger, and Sysco intends to take a bigger slice.” — Kevin Hourican

—

Stay informed. We break down earnings, trends, and policy shifts shaping consumer staples and adjacent industries — no paywalls, no newsletters, just actionable insights wherever you scroll. Follow us on LinkedIn and X for more.

Comments