UNFI Investor Day 2025: Inside the Distributor’s Bid to Become Grocery Retail’s Most Valued Partner

- Hardik Shah

- Dec 11, 2025

- 6 min read

Early in UNFI’s 2025 Investor Day, CEO Sandy Douglas walked on stage in New York and offered a framing that doubled as both a promise and a mea culpa.

“We recognize that in the past, we’ve not always delivered on our full potential,” he told investors. “That’s why we’ve spent the last few years sharpening our priorities and improving execution across the business.”

It was a strikingly forthright start — a tone of realism rather than spin. And it set up a day designed to convince investors that the distributor, long known for its national scale and natural/organic heritage, is quietly but meaningfully becoming a leaner, faster, more disciplined operating machine.

The message was consistent, confident, and unusually cohesive for a company that has historically juggled complexity across conventional, natural, and retail. UNFI now argues those pieces finally align — and that the pieces, together, can produce something the grocery industry badly needs: a scaled growth partner capable of helping independents, premium grocers, and community-focused retailers compete against mass, club, and discounters.

A Company at an Inflection Point

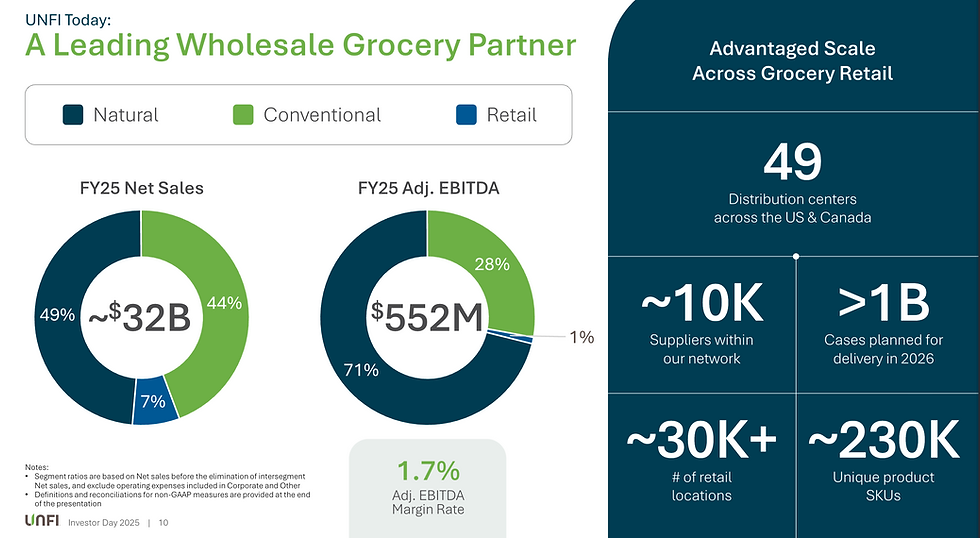

The past few years have been a grind for UNFI. The Supervalu integration took longer than investors liked. Supply chain disruptions exposed structural inefficiencies. And the company’s sprawling footprint — 49 distribution centers, 30,000+ retail locations, 230,000 SKUs — remained more asset than advantage only when run with discipline.

But FY25 marked what management called a “turning point.” UNFI finished the year at or above its initial outlook on net sales, Adjusted EBITDA, and free cash flow.

It also reduced net leverage from 4.0x to 3.3x, the lowest since 2018, giving the company oxygen to invest. And perhaps most importantly, the company rolled out Lean practices across much of the network — a shift CFO Matteo Tarditi describes as foundational, not cosmetic. For UNFI, this matters. The company depends on high-precision operations to maintain customer trust in a business where fill rates and on-time delivery often matter more than price.

The Big Idea: “Shared Profitable Growth”

If Investor Day had a theme, it was simplicity. UNFI repeatedly described its strategy as a flywheel of shared value — a system in which retailers grow, suppliers grow, and UNFI grows alongside them.

The strategy, rests on a three-part engine:

Add value for customers

Add value for suppliers

Improve effectiveness and efficiency

Douglas made the flywheel explicit: “By executing our strategy, we can create a win-win dynamic where our retailers and suppliers grow faster, they generate higher profitability, and we do too.”— Sandy Douglas, CEO

But the underlying engine is much more operational than philosophical. UNFI is moving away from being “a distributor that offers services” to being “a partner with scale and differentiation” — a subtle but meaningful shift in posture.

Where the Growth Lives: Natural, Services, Insights, and Private Brands

UNFI’s business can be distilled into three segments: natural, conventional, and retail. Each has its own economics — and its own strategic role.

Natural Products: The Economic Backbone

Nearly half of UNFI’s revenue and over 70% of EBITDA comes from the natural/organic/specialty segment. This is the company’s heritage, and it remains a critical differentiator. Natural retailers — from premium co-ops to high-growth independents — rely on UNFI not just for distribution, but for assortment curation, speed-to-shelf, and access to emerging brands.

UNFI’s data footprint across 30,000 retail locations gives it a consumer-trend vantage point few distributors match.

Conventional Products: Scale and Stability

Conventional remains 44% of revenue, a ballast that enables UNFI to flex full-basket economics across independents.

The company has been modernizing commercial contracting and simplifying supplier engagement — both areas where inconsistency historically plagued margins.

Retail (Cub & Shoppers): A Strategic Laboratory

Cub, the Midwest leader, is more than a grocery chain. It is UNFI’s test-and-learn sandbox, where the company pilots private brands, loyalty programs, and digital services before pushing them into its wholesale network.

The Operational Engine: Lean, Technology, and a Modern Supply Chain

UNFI’s narrative reached its most tangible and compelling point when Tarditi and the operations team walked investors through a sweeping operating-model overhaul.

This is where the reset becomes more believable.

Lean Daily Management: Discipline at Scale

Lean Daily Management (LDM) — now implemented in 34 out of 49 DCs — provides UNFI with something it long lacked: a daily, standardized operating rhythm.

The results:

Throughput up 9%

Shrink down 16%

On-time delivery up 3%

Such improvements, multiplied across a billion-case network, meaningfully change economics.

AI-Enabled Forecasting & RELEX

UNFI is rolling out RELEX, an AI-powered replenishment and forecasting platform, across its supply chain.

Fill rates have improved materially (indexed 100 → 111 since FY23), and the company expects another lift as RELEX scales.

Better forecasting means fewer stockouts, lower working capital, and improved customer trust — all feeding directly into free cash flow.

Technology Simplification & ERP Modernization

UNFI’s tech stack historically resembled a patchwork. The company is now consolidating systems, modernizing its ERP, and deploying digital tools for customers and suppliers.

CIO Mario Maffie’s mandate is clear: simplify the ecosystem, speed up decision-making, and build resilience into the digital backbone.

The Revenue Engine: Stewardship, Merchandising, Services, and Private Brands

UNFI isn’t just fixing operations — it’s rebuilding the commercial engine.

Customer Stewardship

Customer share of wallet is one of UNFI’s most important metrics.

Average customer share of COGS: 45–55%

Top decile customers: 80%+

The company sees significant room to grow share through tailored programs, insights, and speed-to-shelf.

Merchandising & Supplier Support

UNFI cut SKU setup time nearly 50%, improving supplier onboarding — a key friction point historically.

It’s also investing in emerging brand development via regional “Spark” shows, which help retailers discover innovation earlier.

Professional & Digital Services

This is perhaps the most underrated part of the story. UNFI earns higher margins from services such as:

Payments processing

Loyalty and rewards

Shelf stocking

Digital coupons

UNFI Media Network

Retail media monetization

The average customer uses 2–3 services. Whereas, top users leverage ~6 services. That delta is pure whitespace — and high-margin whitespace.

Private Brands

UNFI’s private brands (>$1B) are positioned for mid-single-digit growth.The opportunity is clear: conventional private brand penetration is 4x that of natural.

If UNFI can help natural retailers accelerate private brands, margins expand for everyone: retailer, supplier, and UNFI.

The Math: A Three-Year Algorithm Built on Margin Expansion

The most consequential part of the day came when CFO Matteo Tarditi laid out UNFI’s new FY25–FY28 financial plan. For a company whose results have historically been patchy, the new algorithm signals confidence.

Revenue

Low-single-digit (LSD) average annual growth

Driven by natural category momentum, services, and customer retention

EBITDA

Low-double-digit (LDD) Adjusted EBITDA CAGR

FY28 target: ~$800M Adjusted EBITDA

Margin expansion from 1.7% → ~2.4% (+65 bps)

“Our updated objectives imply Adjusted EBITDA of around $800 million in fiscal 2028 at an approximate margin of 2.4%, implying an improvement of roughly 65 basis points versus fiscal 2025.”— Matteo Tarditi, President & CFO

Free Cash Flow

$300M per year through FY28

Supported by working capital gains and disciplined capex

Leverage

<2.5× by FY26

<2.0× by FY27

This deleveraging means Adjusted EPS is expected to grow faster than EBITDA — a point management emphasized repeatedly.

The Leadership Philosophy: Culture as Operating System

Chief Human Resources Officer Danielle Benedict showcased a leadership bench blending legacy institutional knowledge with high-profile hires from General Mills, Target, GE, McDonald’s, and Mars.

The cultural mantra — “better every day, do the right thing, win together” — was more than HR boilerplate. It tied directly to Lean, capability-building, and commercial modernization.

The company is developing homegrown operators and merchandising leaders through structured internal programs (UNFI Elevate, Leaders in Supply Chain), creating what Benedict called a “next-generation leadership engine.”

“Our purpose is deeply tied to our culture. While our business has evolved, our passion for serving customers and suppliers remains strong — it’s what fuels our high-performing culture.”— Danielle Benedict, CHRO

Can They Pull It Off? The Watchlist for Investors

UNFI’s strategy is coherent. The targets are ambitious. The narrative is clear.But as Douglas acknowledged, the challenge is consistency. Investors should watch:

1. Services Penetration

The jump from 2–3 services per customer to 4–5 would meaningfully change the margin profile.

2. Private Brands Mix

Natural-channel private brands represent one of UNFI’s biggest margin levers.

3. EBITDA Margin Trajectory

Even quarterly progress toward 2.4% will be meaningful.

4. Leverage Reduction

Progress to <2.5× by FY26 is critical.

Risks That Could Break the Story

This isn’t a risk-free plan.

Grocery market dynamics remain unforgiving; club, mass, and discounters continue to take share.

Supplier funding cycles may remain unpredictable.

Technology transformation introduces integration risks.

Labor and logistics constraints could resurface.

Customer concentration means large wins and losses matter disproportionately.

UNFI must deliver operational excellence, not just operational aspiration.

The Bottom Line: A Repositioned UNFI That Finally Has a Tailwind

The 2025 Investor Day wasn’t a flashy reinvention. It was something more valuable: a coherent, operationally grounded plan that aligns strategy, capabilities, financials, and culture.

For the first time in years, UNFI looks less like a company fighting fires and more like a company building a system — one that blends scale, category expertise, technology, and higher-margin services into a durable model.

If UNFI executes, the company could transition from a volatile distributor to a dependable compounder with a clearer margin story, cleaner balance sheet, and stronger customer stickiness.

The next 18–24 months will determine which version investors ultimately believe. But as of Investor Day 2025, UNFI offered the most credible narrative it has presented in a decade — and the clearest path toward becoming the industry’s most valued partner.

—

Comments