Wingstop Earnings: Growth Engine Intact Despite Comp Pressure

- 1 day ago

- 4 min read

TL;DR

Revenue Strength: Double-digit system-wide sales growth driven by record restaurant openings.

Margin Trends: Adjusted EBITDA expanded despite macro pressure on same-store sales.

Forward Outlook: Smart Kitchen execution, loyalty launch, and development pipeline expected to restore comps to growth.

Business Overview

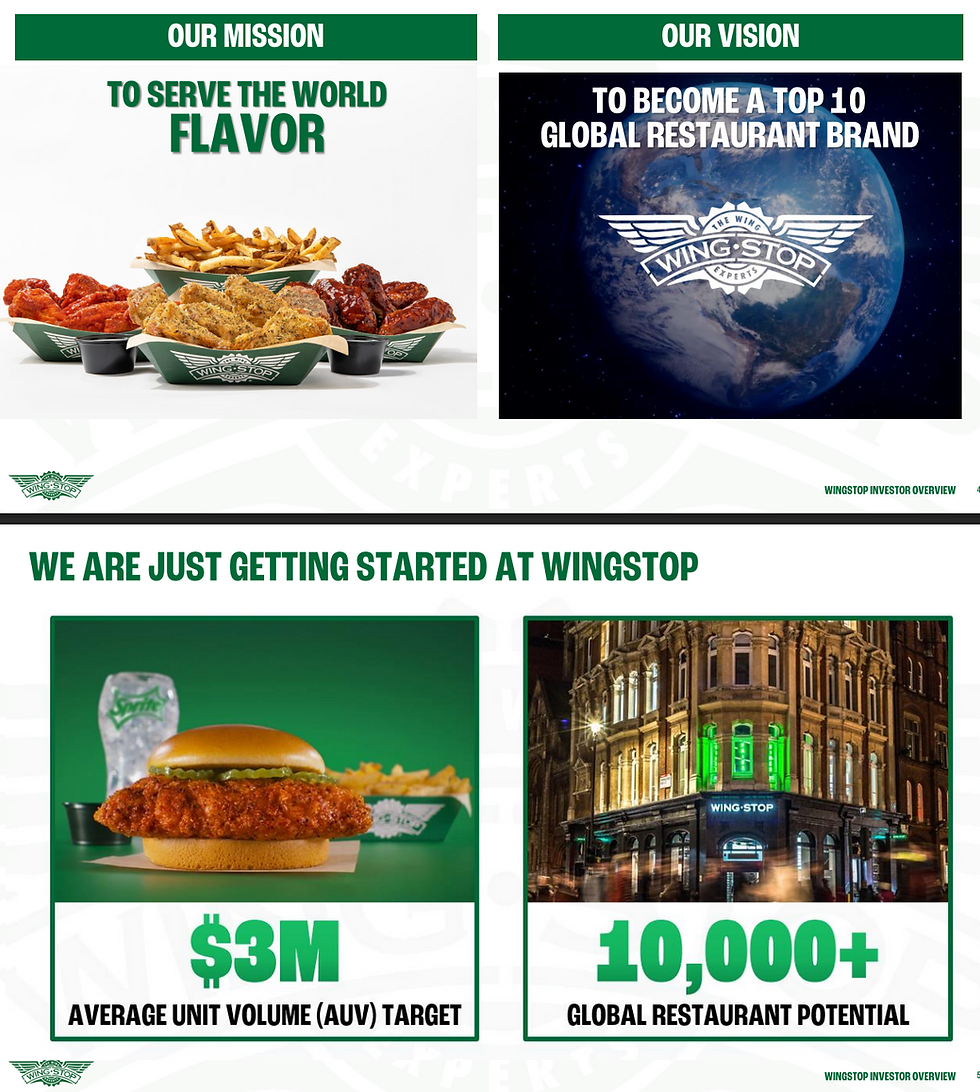

Wingstop is a predominantly franchised quick-service restaurant (QSR) brand focused on cooked-to-order chicken wings, tenders, sandwiches, and flavored sides. The company operates an asset-light franchise model, with roughly 98% of restaurants owned by franchise partners. The business generates revenue primarily from:

Franchise royalties and fees

Advertising fund contributions

Company-owned restaurant sales

The brand surpassed 3,000 global restaurants in 2025 and generated more than $5 billion in system-wide sales, supported by strong digital penetration and international expansion.

Wingstop’s strategic positioning centers on off-premise group dining occasions, strong digital ordering adoption, and differentiated flavor-driven menu positioning.

Wingstop Earnings Performance

Revenue

Wingstop reported fourth-quarter revenue of $175.7 million, an 8.6% increase year over year, supported primarily by continued franchise development and higher advertising fund contributions tied to system growth. System-wide sales reached $1.3 billion, rising 9.3% from the prior year, reflecting the company’s ongoing expansion strategy and strong development pipeline.

Despite these gains, comparable-restaurant performance remained under pressure. Domestic same-store sales declined 5.8% in the quarter, marking the most significant headwind in an otherwise growth-oriented operating model.

For the full fiscal year, Wingstop still delivered solid top-line momentum. Revenue increased 11.4% to $696.9 million, while system-wide sales grew 12.1% to $5.3 billion, underscoring the strength of the brand’s franchise-led expansion strategy.

Management indicated that new restaurant openings were the primary driver of system-wide growth, while softer traffic trends — particularly among value-sensitive consumers — weighed on same-store sales performance during the year.

Margins and Profitability

Fourth quarter profitability (GAAP):

Net income: $26.8 million

Diluted EPS: $0.96

Adjusted results (non-GAAP):

Adjusted net income: $27.8 million

Adjusted EPS: $1.00

Adjusted EBITDA: $61.9 million (+9.8%)

For the full year 2025:

Net income: $174.3 million (+60%)

Adjusted EBITDA: $244.2 million (+15.2%)

Cost-of-sales margin improved to 75.6% of company-owned restaurant sales, benefiting from lower wing costs and operating leverage.

“Adjusted EBITDA in Q4 increased approximately 10% versus 2024 to $61.9 million, underscoring the durability of our model.” — Alex Kaleida, SVP & CFO

Forward Guidance

Wingstop’s 2026 guidance includes:

Flat to low-single-digit domestic same-store sales growth

15%–16% global unit growth

SG&A: $151–$154 million

Interest expense: ~$43 million

Management expects adjusted EBITDA growth of roughly 15% in 2026.

“2026 will leverage these strategies by expanding awareness and consideration to bring in new guests and increase frequency among our current guests.” — Michael Skipworth, President & CEO

Risks & Opportunities

Risks

Continued pressure on lower-income consumers

Execution risk around Smart Kitchen operational consistency

Delivery-platform execution gaps

Higher interest expense following securitization financing

Opportunities

Loyalty program rollout

Global expansion pipeline

Smart Kitchen productivity gains

Digital customer database growth

Operational Performance

Wingstop opened 493 net new restaurants in 2025, representing 19.2% unit growth, one of the strongest development years in company history.

“Our 2025 results showcased the resiliency of our asset-light, highly franchised model and demonstrated the opportunity we have to scale Wingstop to over 10,000 restaurants globally.” — Michael Skipworth, President & CEO

The company completed the rollout of Wingstop Smart Kitchen across all domestic restaurants, enabling:

Faster service times

Better operational visibility

Improved labor productivity

Increased lunch-daypart transactions

Early data suggests restaurants consistently hitting the 10-minute service target are seeing improved customer frequency.

Consumer Demand, Pricing, and Category Dynamics

Wingstop experienced its first same-store sales decline in 22 years, reflecting macroeconomic pressure on core consumers.

Lower-income customers remained under pressure, particularly in lunch and snack dayparts, while dinner occasions remained resilient.

Digital engagement continued to grow:

Digital sales represented 73.2% of system-wide sales

The digital customer database grew 20% in 2025

Management is focused on engineering demand through speed, loyalty, and marketing, rather than price-led promotions.

Category takeaway:The wing category remains resilient for group occasions, but traffic-sensitive dayparts reveal ongoing consumer elasticity pressures across QSR.

Strategic Initiatives

Wingstop’s strategy now centers on three growth engines:

Smart Kitchen platform

AI-enabled kitchen operating system

Designed to improve speed and consistency

Supports scaling AUV toward $3 million

Club Wingstop loyalty program

Pilot showed 7% frequency increase among enrolled guests

National launch planned for late Q2 2026

Global expansion

Entry planned into India

Continued international market launches

Pipeline of ~2,300 committed restaurants

Capital Allocation

Wingstop continued returning capital to shareholders.

Quarterly dividend: $0.30 per share

Q4 share repurchases: 248,278 shares

Remaining authorization: $91.3 million

The company returned over $250 million to shareholders in 2025 through dividends and buybacks.

The Bottom Line

Wingstop’s quarter reinforced a key investor narrative: development-led growth remains intact even as traffic softens. Three takeaways investors should watch:

Execution on Smart Kitchen adoption will determine the pace of traffic recovery.

Club Wingstop loyalty launch could materially improve frequency and retention.

Global unit growth visibility remains unusually strong for a restaurant brand.

Despite near-term comp pressure, Wingstop’s asset-light franchise model, strong unit economics, and global pipeline continue to support long-term growth toward management’s 10,000-restaurant ambition.

—

Stay informed. We break down earnings, trends, and policy shifts shaping consumer staples and adjacent industries — no paywalls, no newsletters, just actionable insights wherever you scroll. Follow us on LinkedIn and X for more.

Comments